Medical College of Wisconsin Benefits

The Medical College of Wisconsin (MCW) understands that everyone has different needs when it comes to benefits, which is why we offer a range of comprehensive, affordable plans that you can customize for you and your family. Your benefits may differ slightly based on full-time or part-time status, as well as position level.

Benefits at a Glance

Apply Now

-

Search for Staff & Postdoctoral Openings

Learn More -

Search for Faculty Openings

Learn More -

Search Openings for Current MCW Employees

Learn More -

Physician and APP Recruitment

Learn More

Contact Human Resources

Let us help you find answers to your questions.

Employment Office

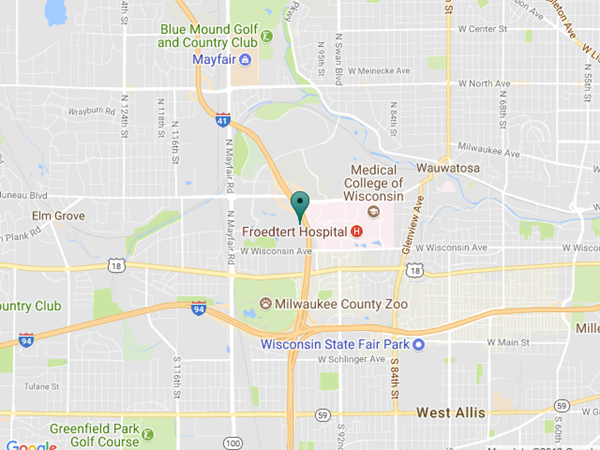

Medical College of Wisconsin

10000 Innovation Dr., Suite 140

Wauwatosa, WI 53226

Inquiries

(414) 955-8245

Office Hours

Monday – Friday

8 a.m. to 5 p.m.

*Additional hours available by appointment.

Employment and Income Verification

All employment or payroll/salary verifications should be directed to The Work Number.

Medical College of Wisconsin’s employer code is 19861.

www.theworknumber.com/verifiers

1 (800) 367-5690